Almost all retail investors (you and I) are involved in the stock market. Ever since I can remember, I was always told that investing in the stock market for the long term is the soundest strategy for investing my money.

It wasn’t until I learned about apartment investing that my view has changed. The information below really opened by eyes to what real estate investing can do for one’s wealth over time.

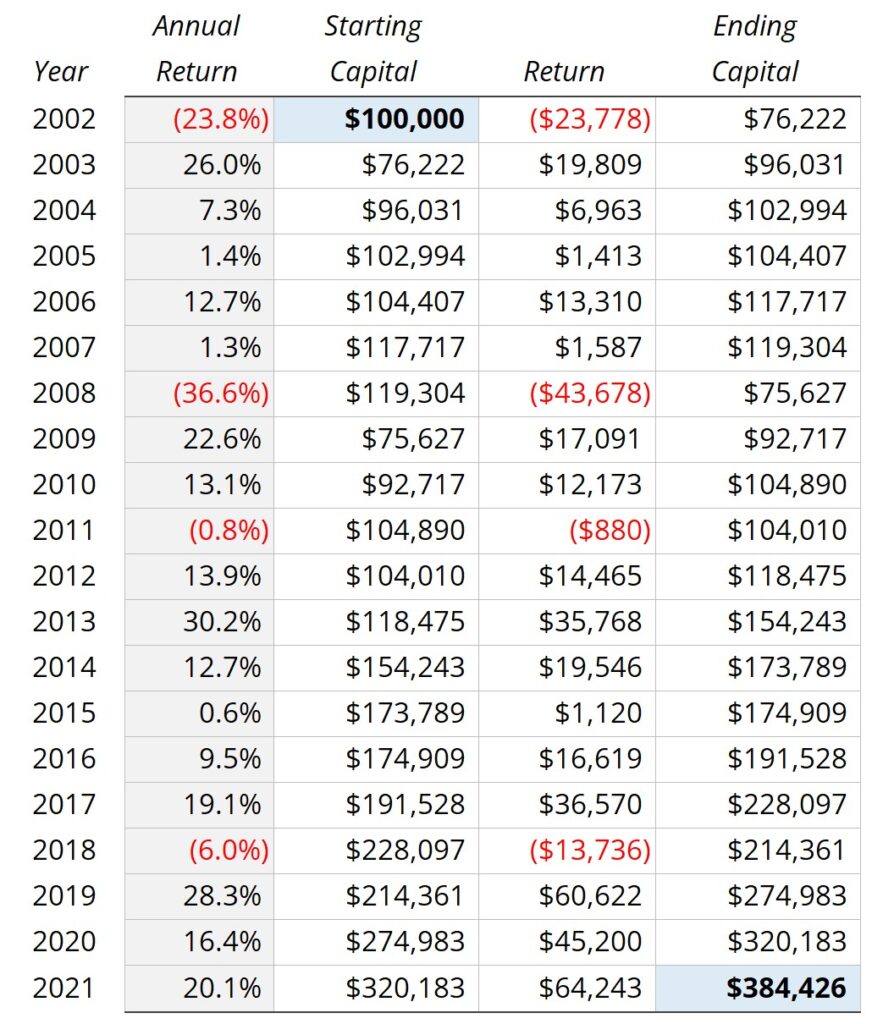

Let’s take an example where we start with a $100k investment made 20 years ago into the S&P 500 and see how it performed based on the inflation-adjusted annual returns (Source: NYU Stern School of Business)

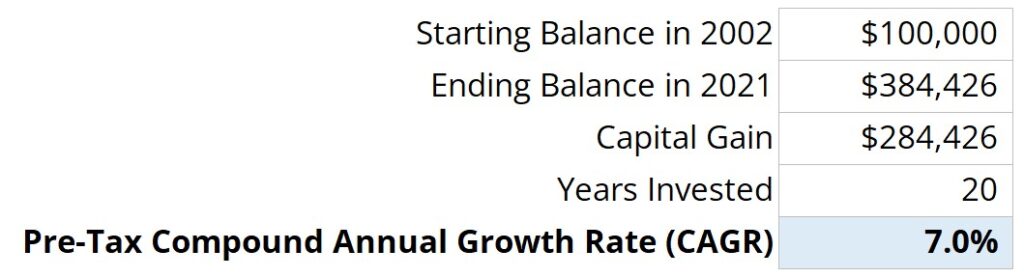

Starting in the beginning of 2002 with $100k using the annual returns each year, you would have arrived at $384k by the end of 2021. What’s the compound annual growth rate (CAGR)?

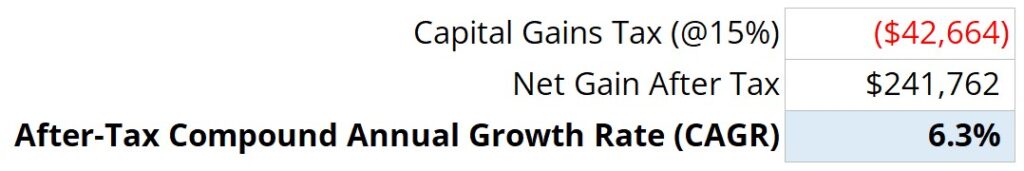

The pre-tax compound annual growth rate is 7.0%. If you decide to pull out your money after those 20 years, you’ll have to pay capital gains tax, which for most of us is 15%. Removing that 15% of tax would leave you with a 6.3% compound annual growth rate. And this doesn’t even take into account what’s currently going on in the stock market (S&P500 is already down 14.5% this year).

Now, inflation is already take into account with these returns values, but there’s another factor that also negatively effect this 6.3% return… fees.

Most retail investors usually pay fees to advisors to manage their investments. These fees can range from 1% to substantially more, depending on their fee structure, and further reduce the returns the investor sees.

How Does Apartment Investing Compare?

If we look at a recent apartment investing offering I made available to investors, the average annual return was 17%. That’s substantially higher than 6.3%, isn’t it?

So what about taxes, inflation and fees?

- Taxes – One of the great benefits of real estate investing is the preferrable tax treatment it gets. Using depreciation, you can essentially pay zero in taxes! Using some real estate-specific tax strategies, you can carry forward those benefits as long as you’d like. A good CPA will show you how.

- Inflation – Apartments are a great hedge against inflation because they tend to become more valuable as inflation increases. Why? Because rents increase along with the price of gas, food and other household expenses.

- Fees – While there are fees involved in apartment syndications, the 17% return I quoted above is after fees!

I haven’t even mentioned the fact that, through apartment investing, you can invest in real estate in a completely passive way. No weekend phone calls with plumbing issues, not missing rent payments, no hassles… period.

It took an investor who put $100k into the S&P 500 in 2002 over 15 years to double their money. Our apartment investments can double in 5-6 years. That’s a substantial difference!

If I would have known about this earlier, I could have been much further ahead in my personal financial goals.

If you’re still reading this, I commend you for taking note of what I’m talking about. Now you understand the power of apartment investing.

If you’d like to learn about how to get involved apartment investing, feel free to download my Passive Real Estate for Working Professionals e-book. This guide walks you through the ABCs of apartment investing in a simple way.